亲爱的CFA学员:欢迎来到融跃教育CFA网!

距离 2026/2/2 CFA一级考期还有 天!

全国热线:400-963-0708

全国热线:400-963-0708  网站地图

网站地图

发布时间:2022-02-13 09:29编辑:融跃教育CFA

CFA三级知识考察考生的综合和应用能力,在备考中也是要学习知识的,那在CFA知识中的股票投资相关知识你是不是掌握了?知道CFA知识点中的作用有哪些?跟着小编看看!

股票投资主要有4方面的作用:capital appreciation、dividend income、diversification、 potential to hedge inflation。

01、Capital Appreciation资本增值

Capital appreciation results from investing in companies that are experiencing growth in cash flows, revenues, and/or earnings.

资本增值来自于企业盈利能力和现金流的成长。

(1)Equity returns on average have been higher than bonds and bills.

长期来看,股票的收益高于债券;

(2)In general, equities tend to outperform other major asset classes during periods of strong economic growth, and underperform during periods of weak economic growth.

一般而言,经济状况好时,股票优于债券;经济状况差时,债券优于股票。

02、Dividend Income获得分红

When companies generate excess cash flows, they can decide to either reinvest those cash flows in value added projects or distribute them to investors in the form of dividends. Wellestablished companies often pay dividends to investors.

企业可以选择将盈利再投资,也可以以红利的方式发放给股东。成熟的企业一般选择分红。

03、Diversification分散化

Equity securities offer diversification benefits due to less than perfect (i.e., less than +1.0) correlation with other asset classes.

股票可以起到分散化的作用,降低整个投资组合的相关性。

(1)When assets are less than perfectly correlated, portfolio standard deviation will be lower than the weighted sum of the individual asset standard deviations.

只要各类资产之间的相关性不是1,那么组合的风险就低于各资产波动性的加权和;

(2)During a financial crisis, correlations tend to increase, limiting the diversification benefit.

经济危机发生时,各资产的相关性会增大,即使组合投资比较分散,效果也会减弱。

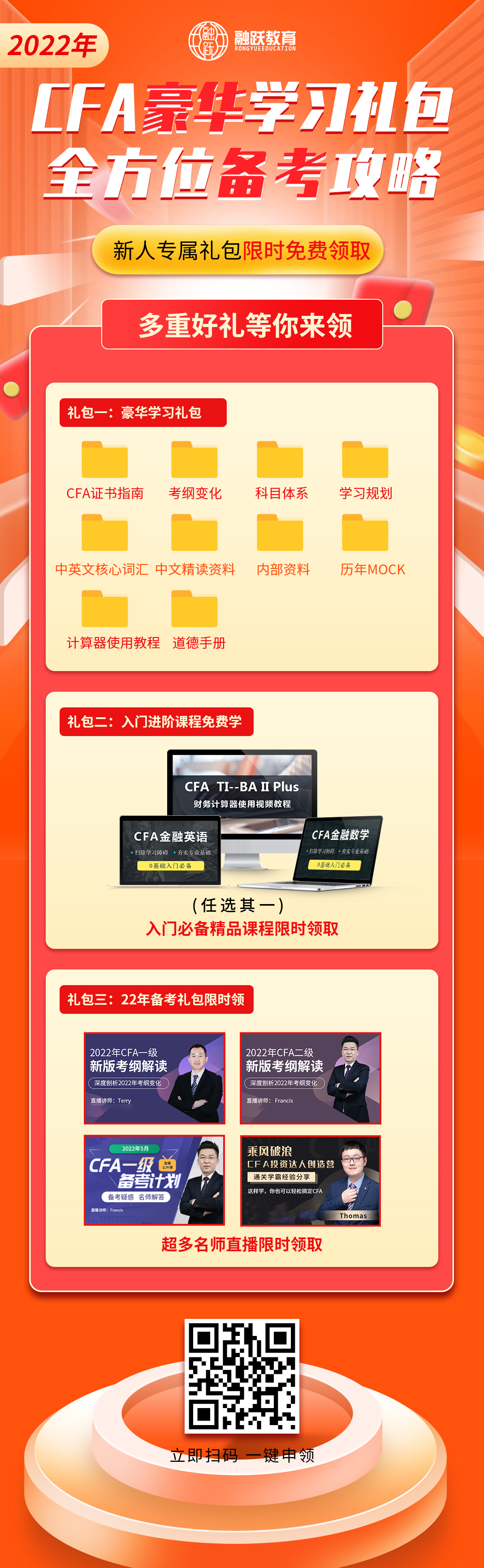

CFA备考怎么能少了CFA备考资料呢?小编为各位考生准备了CFA备考资料,有需要可以点击下方链接获取!

戳:各科必背定义+历年真题中文解析+学习备考资料(PDF版)

04、Inflation Hedge对冲通胀

Individual equities or equity sectors may provide a hedge against inflation.

某些板块的股票 是可以对冲通胀的。

(1)A company that can charge its customers more when input costs increase (due to inflation), can provide an inflation hedge by increasing to cash flow and earnings as prices increase.

提价能力较强的公司可以转嫁成本给顾客;

(2)Commodity-producing companies (e.g., oil producer) may also benefit directly from commodity price increases.

生产原材料的公司在通胀时盈利能力提高;

(3)Some studies show that equities and inflation become negatively correlated during periods of hyperinflation.

恶性通胀时,股票收益与通胀水平负相关;

CFA知识学习是长期的事情,但是坚持CFA考试是每一位学员应该做到的。通过CFA考试掌握更多的金融知识,让自己变成富有的人。更多CFA备考知识、资料领取及学习答疑的事情,学员可以在线咨询老师或者添加老师微信rongyuejiaoyu。

下一篇:2022年5月CFA三级更改考点截止到北京时间4月24日中午12:59!

精品文章推荐

打开微信扫一扫

添加CFA授课讲师

课程咨询热线

400-963-0708

微信扫一扫

还没有找到合适的CFA课程?赶快联系学管老师,让老师马上联系您! 试听CFA培训课程 ,高通过省时省心!