首页 > CFA考题 > 正文

CFA一级易错题:An analyst has made the following return projections

发布时间:2023-07-21 15:40 编辑:融跃教育CFA

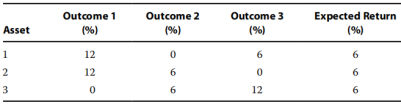

An analyst has made the following return projections for each of three

possible outcomes with an equal likelihood of occurrence:

Which pair of assets is perfectly negatively correlated?

A Asset 1 and Asset 2.

B Asset 1 and Asset 3.

C

(组合管理 Portfolio Risk and Return: Part I)

资产2的收益是12→6→0,逐渐下降,而资产3的收益是0→6→12,逐渐上升,可以画个坐标轴,x轴代表资产2的收益,y轴代表资产3的收益,画出的曲线向下倾斜。

声明:本文章为学习相关信息展示文章,非课程及服务内容文章,产品及服务详情可咨询网站客服微信。文章转载须注明来源,文章素材来源于网络,若侵权请与我们联系,我们将及时处理。

上一篇:CFA一级易错题:Interquartile range=Q3−Q1+Box and whisker plot

下一篇:CFA一级易错题:Empirical duration is likely the best measure of the impact

精品文章推荐

CFA三级考试备考规划!

时间:2025-12-11 作者:融跃CFA官网

备考CFA三级也就意味着我们距离CFA证书又近了一步,那么在备考CFA三级的时候要如何做呢?如果你还没有头绪也不要着急,小编已经给大家整理好了,下面来跟着小编一起来看看吧!

CFA二级考试备考规划怎么做?

时间:2025-12-11 作者:融跃CFA官网

近期小编看到有不少朋友在问关于CFA二级考试备考规划怎么做的问题,如果你也有这方面的问题,那么下面小编的这些内容大家一定不能错过。

CFA一级考试备考规划如何做?

时间:2025-12-11 作者:融跃CFA官网

CFA一级对于整个CFA考试来说是一个基础的作用,所以在备考CFA一级的时候一定要做好备考规划,小编也给大家整理了一下CFA一级考试的备考规划,希望可以在大家备考过程中提供帮助。

持有CFA证书的从业方向有哪些?

时间:2025-12-11 作者:融跃CFA官网

了解过CFA证书的朋友应该知道,CFA证书是金融行业的高含金量证书之一,那么可能有些朋友会比较疑惑考下CFA证书之后可以从事的工作方向有哪些呢?如果你也有这方面的疑问,那么下面小编整理的这些内容或许可以解答。

CFA一级考试备考重点有哪些?

时间:2025-12-11 作者:融跃CFA官网

CFA一级考试对于很多朋友来说刚开始是比较难的,因为不知道如何有选择性的备考,所以在备考时间上面可能会安排的不恰当,为了让大家在备考CFA考试的时候更加合理的安排时间,小编给大家整理了一下CFA考试备考重点,帮助大家更快的进入备考状态。

CFA二级备考误区!

时间:2025-12-11 作者:融跃CFA官网

CFA二级作为整个CFA考试中重要的一场考试,大家在备考的时候一定要注意备考中的误区,提前避免帮助我们少走弯路,提高备考效率。小编给大家整理了一些CFA二级备考误区,希望可以在大家的备考过程中提供帮助。

CFA三级考试科目有哪些?

时间:2025-11-28 作者:融跃CFA官网

中文科目名称英文科目名称权重占比(浮动范围),投资组合管理与财富规划Portfolio Management and Wealth Planning35%-40%,固定收益投资Fixed Income15%-20%,职业伦理道德Ethical and Professional Standards10%-15%

CFA二级考试科目有哪些?

时间:2025-11-28 作者:融跃CFA官网

中文科目名称英文科目名称权重占比(浮动范围),职业伦理道德Ethical and Professional Standards10%-15%,财务报表分析Financial Statement Analysis10%-15%

CFA一级考试科目有哪些?

时间:2025-11-28 作者:融跃CFA官网

对于想要报考CFA考试的朋友来说,了解考试的科目是我们备考环节中不可缺少的一部分,下面小编就来和大家说一下CFA一级的考试科目有哪些。

持有CFA证书就业前景怎么样?

时间:2025-11-28 作者:融跃CFA官网

CFA证书是金融行业含金量和认可度都比较高的证书之一,很多朋友想要了解持有CFA证书之后的就业前景如何,下面小编就来和大家详细的说一下。

推荐课程

全国热线:400-963-0708

全国热线:400-963-0708  网站地图

网站地图